How Much is Your Vagina Really Costing You? The Tampon Tax and Gender Price Discrimination

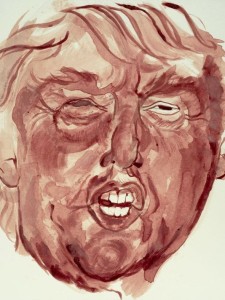

Portrait of Donald Trump made out of period blood in response to Trump’s comments on Fox News reporter Megyn Kelly’s period. By artist Sarah Levy

Walking down the hall of almost any Scripps dorm, you’ll notice a bowl of condoms and occasionally a few remaining packs of lubricant sitting on a table. These items, provided by our RAs, are considered a necessity to our health, as protected-sex should be. However, at our college, there is no free or paid access to tampons in bathrooms or hallways. This led me to question to what extent do society, our schools, and the government’s taxation policies view periods as an option, but sex as inevitable?

In the US and Australia, feminine hygiene products are taxed up to 10%, while “necessary” items like condoms, lubricants, and sunscreen are categorized as “essentials.” In the UK, they receive an additional sales tax, as they are classified as “luxury goods” along with fine olives and jams, but other items, like pita bread and rare meats such as crocodile and kangaroo, remain exempt. So should we all start to use pita bread as pads for extra coverage to avoid this extraneous tax?

This July, Canada was the first to take a stand. Tampons, pads, and other sanitary products were released from the country’s 5% “goods and services” tax, leading feminists in the UK and many other countries to question their own countries’ current legislation. Right now, 40 states in the US have a current sales tax on tampons, five have labeled them a necessity along with diapers and toilet paper, and the remaining five do not practice any form of sales tax at all.

On January 8, California Assemblywomen Cristina Garcia and Ling Ling Chang introduced a bill, currently in review, that would classify feminine hygiene products as medical necessities. In the US, the tampon tax brings in about 20 million dollars of revenue every year, which in the scheme of things, isn’t that large. However, a box of tampons costs an average of $7, not to add the additional cost of panty liners, medication to cure cramps, and the many new pairs of underwear we’ll need to buy because we didn’t make it to the bathroom in time. Including the additional taxes, this can total over $11,000 spent on materials associated with periods in one lifetime.

For an individual, the extra pennies every month start to add up. The average working white woman in America makes 78 cents to every dollar that a man makes. Hispanic and black women earn even lower average wages of 64 cents and 56 cents respectively. The gender pay gap exists, and what the tampon tax has brought attention to is the overall “pink tax” that women pay simply for being women. As Jezebel Magazine’s Tracie Egan Morrissey puts it, “How much does owning a vagina really cost?”

Products marketed towards women cost an additional 7% compared to men’s, even if they are identical, like razors, shampoo, and lotions. Because of the beauty standards associated with being a woman, companies assume women will pay more, when in reality, the demand is nearly the same. Recently, in New York City, an undercover female reporter brought in a Ralph Lauren button down shirt to the dry cleaner’s and was charged $7.50. The same shirt, when containing a “Men’s” tag, was later priced at $2.85 for an identical cleaning. The reasoning behind this? Apparently the machines were designed to clean shirts with buttons on the left, men’s shirts, and take more time and energy when the buttons are on the right, as are women’s. However, Ralph Lauren makes both their men’s and women’s shirts identical, thus proving this “pink tax” not a myth.

Many argue that the tampon tax issue has been blown out of proportion, as all governments have the right to determine their own sales tax per product and demand rate. However, gender price discrimination exists, and women are the ones paying for it.

Jess is a first-year at Scripps. She loves to travel, paint, explore new countries and cultures, and talk about feminism. She plans to major in Feminist, Gender, and Sexuality Studies.

![[in]Visible Magazine](https://community.scrippscollege.edu/invisible/wp-content/uploads/sites/5/2011/04/Invisible-Masthead-2011-Spring1.png)

Comments are closed.