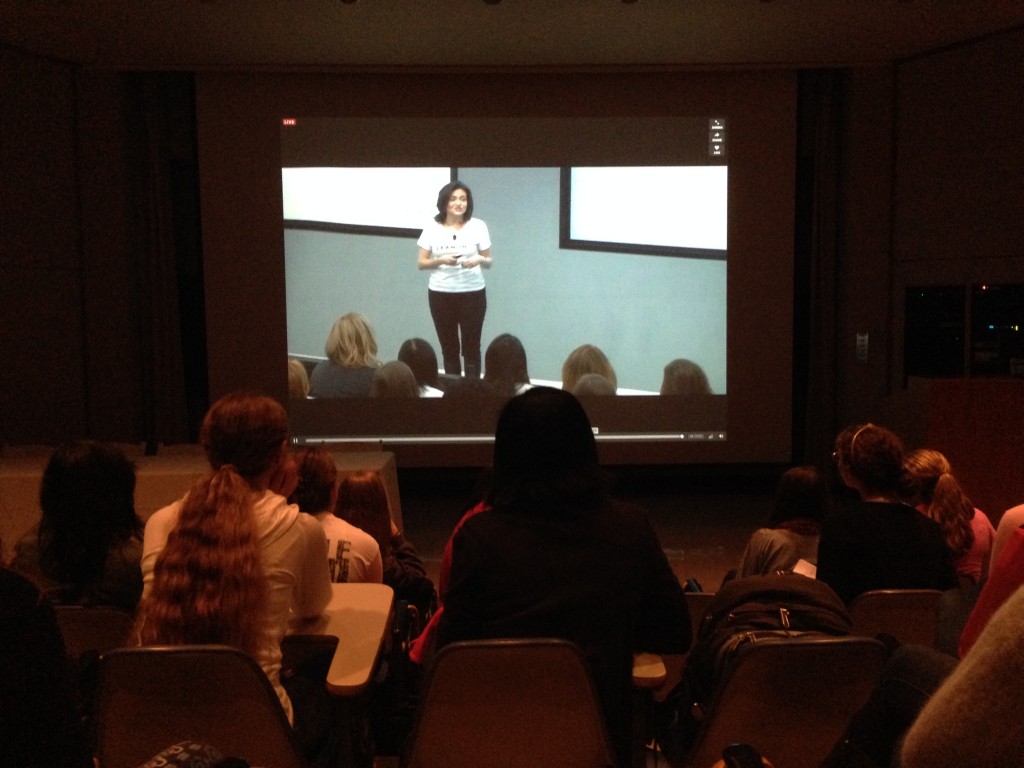

A few weeks ago, Scripps tuned in to Sheryl Sandberg’s video conference* to discuss her New York Times bestseller, Lean In: Women, Work, and the Will to Lead. About 150 schools all over the world joined the discussion on Twitter, along with students from NorCal who had the privilege to see her in person.

Many students gathered in Balch Auditorium to watch the live feed to Sheryl Sandberg’s video conference.

Sheryl Sandberg is the current COO of Facebook and is considered to be one of the most successful women in the modern business world. Not only is she responsible for billions of dollars in assets, outside of work, she boasts a balanced family life and a loving relationship with her husband. She seems to be one of the very few professional women in the world who truly “has it all.”

A few months ago, 60 Minutes interviewed her about her prolific career at Google and Facebook, and on the advice she has for other aspiring professional women. Her answer is for women to “lean in.”

The entirety of the video conference revolved around this one concept of “leaning in,” the namesake of her book. She diagnoses the greatest issue plaguing women’s achievement is our tendency to “lean back” in life decisions. When it is time to make certain decisions that would greatly impact our career, we end up choosing the wrong paths for fears of what would happen in the future [Ex: My boss won’t like it if I don’t fit in…If I am more aggressive, will my coworkers stop liking me? What if I get married? What if I want to have kids? What if I am not good enough?].

She doesn’t discount these fears. In fact, she believes these fears are so perpetuated in society that there is nothing better we can do for ourselves instead to “lean in:” take risks, do what’s right for you, and do not apologize for taking charge of your ambition.

She believes so strongly in this fundamental concept that she launch a nonprofit organization designed for women to help others succeed in their professional endeavors. All around the world, there are now “circles” where women can discuss her book, host career workshops, and become mentors for one another. I was not a fan on how much time Sandberg allocated in conference talk to advertise students to expand this “circle network” to their college campuses. Despite my annoyance, she does have a point and her mission is a very very large undertaking for a single woman.

Although I have some reservations about Sandberg’s theory, overall, I think she is an excellent role model and I have a huge admiration for her and her work. I just purchased my copy of Lean In: Women, Work, and the Will to Lead and am looking forward to join the Scripps’s book discussion on Friday, November 15th at 4pm at the Student Union, hosted by the Scripps College Economics Society.

What are your thoughts about Lean In and/or the live video conference? Comment below!

* Note: The video is of last April’s college video conference.